The search for the right tax advisor can be a challenging task, especially when you are not sure what you need them for and what costs you might incur. However, a tax advisor is a valuable partner who helps you manage your business financially from the start. In this guide, you will learn why you need a tax advisor and how to find the right one for your needs.

Key insights

- A tax advisor is not legally required, but highly recommended.

- The costs for a tax advisor can start low and increase with the complexity of your business.

- Look for a tax advisor who understands your specific needs and has current reviews.

Step-by-Step Guide to Finding a Tax Advisor

Step 1: Recognize the Need for a Tax Advisor

The decision of whether you need a tax advisor depends on your business situation. It is not legally required to hire a tax advisor, but they help you stay focused on your core business. For example, if you start a business and have no substantial tax knowledge, you are likely to waste a lot of time and may also make mistakes that can ultimately be expensive. It is recommended to hire a tax advisor to keep track and avoid legal issues.

Step 2: Understand the Cost Framework

The costs for a tax advisor are not constant and depend heavily on the size and complexity of your business. In the first year, the expenses for a tax advisor could range between 600 and 2000 euros. However, if your business revenue increases significantly or you operate multiple businesses, the costs can also rise considerably. It is important to clarify your cost expectations in advance.

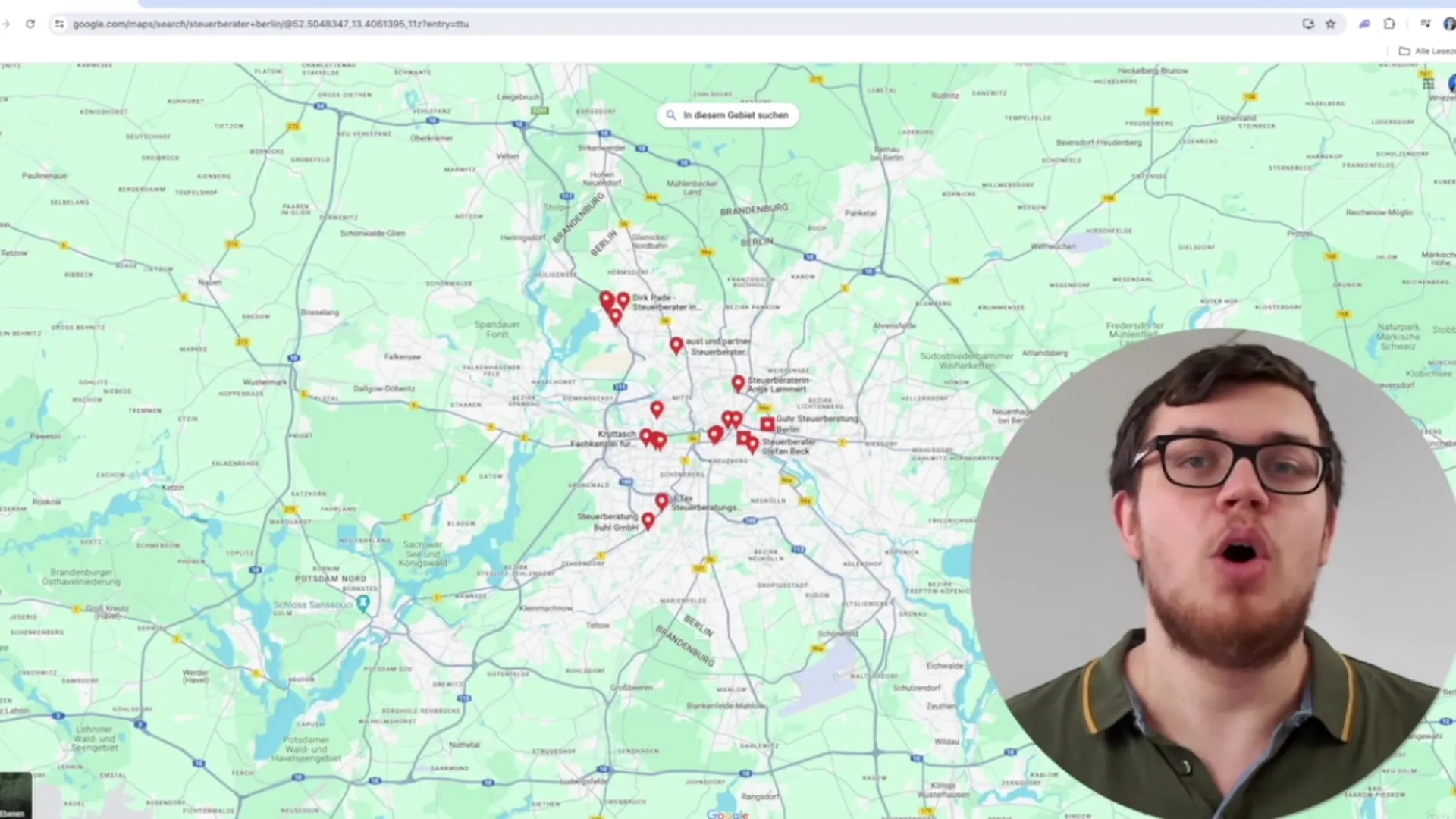

Step 3: Online Research

To find a suitable tax advisor, start with an online search. Google Maps is a good tool to find tax advisors in your area. Enter your address and look for the highest-rated tax advisors. It is advantageous to have a tax advisor nearby as in-person conversations are often more effective than just phone calls or video calls.

Step 4: Check Reviews

Once you have a list of tax advisors in your area, check their online reviews. Pay attention not only to the number of reviews but also to the quality of those reviews. Genuine and detailed feedback gives you better insight into a tax advisor's competence. Also, use your common sense to assess the authenticity of the reviews.

Step 5: Seek Recommendations

Ask for recommendations in your network, especially from friends or family members who are self-employed. A personal recommendation is often more valuable than anything you find online. If someone has had good experiences with a tax advisor, the chances are high that you will have a similar experience.

Step 6: Review Tax Advisors' Websites

Visit the websites of the tax advisors you have shortlisted. Ensure they do not only specialize in employees and sole proprietorships. A good tax advisor should also have experience with corporations, in case you plan to expand in the future. This shows you that they are capable of assisting you with more complex tax issues.

Step 7: Conduct Personal Meetings

Once you have found some suitable tax advisors, schedule personal appointments. Pay attention to how comfortable you feel during the first conversation. A good gut feeling is crucial. Your tax advisor will be an important partner for the future of your business, so it is important that you have trust.

Step 8: Decision Making

After the initial personal meetings, you will likely have a better sense of who the right tax advisor is for you. Compile the offers and impressions you have gathered. Also consider the costs and specialty areas of the tax advisors before making a final decision.

Step 9: Provide Further Information

After you have decided on a tax advisor, prepare all necessary information for them. This includes your sources of income, invoices, and relevant documents. A competent tax advisor will willingly and actively engage with your documents and provide you with the best solutions.

Step 10: Start Collaboration

A good collaboration with your tax advisor is key to successful business management. Communicate openly and transparently about your expectations and special topics. A tax advisor should prioritize your concerns and specifically address optimizing your tax situation and preventing potential issues.

Summary - Finding a Tax Advisor – Your Guide to the Right Partner

The choice of a tax advisor is crucial for the success of your business. You will learn why it is important to have a tax advisor and how to find the perfect partner. Pay attention to costs, reviews, personal recommendations, and the complexity of your tax needs.

FAQ

How much does a tax advisor cost?The costs vary depending on the complexity of the business and average between 600 and 2000 euros in the first year.

Is a tax advisor absolutely necessary?A tax advisor is not legally required, but it is recommended to rely on their advice to save time and avoid mistakes.

How do I find the right tax advisor for my online business?Use Google Maps to search for tax advisors nearby and check their reviews and websites.

What should I pay attention to in a first meeting?Pay attention to your gut feeling and how competently the tax advisor informs and advises you.

Could a tax advisor also be helpful with international issues?Yes, a competent tax advisor should be able to assist you with international tax questions if needed.