The choice of the right form of business is a crucial step for your business. Perhaps you have already thought about the sole proprietorship or the UG, but did you know that there are many other options? In this guide, you will learn everything about the various forms of business in Germany, what sets them apart, and which one suits your individual situation the best.

Main insights

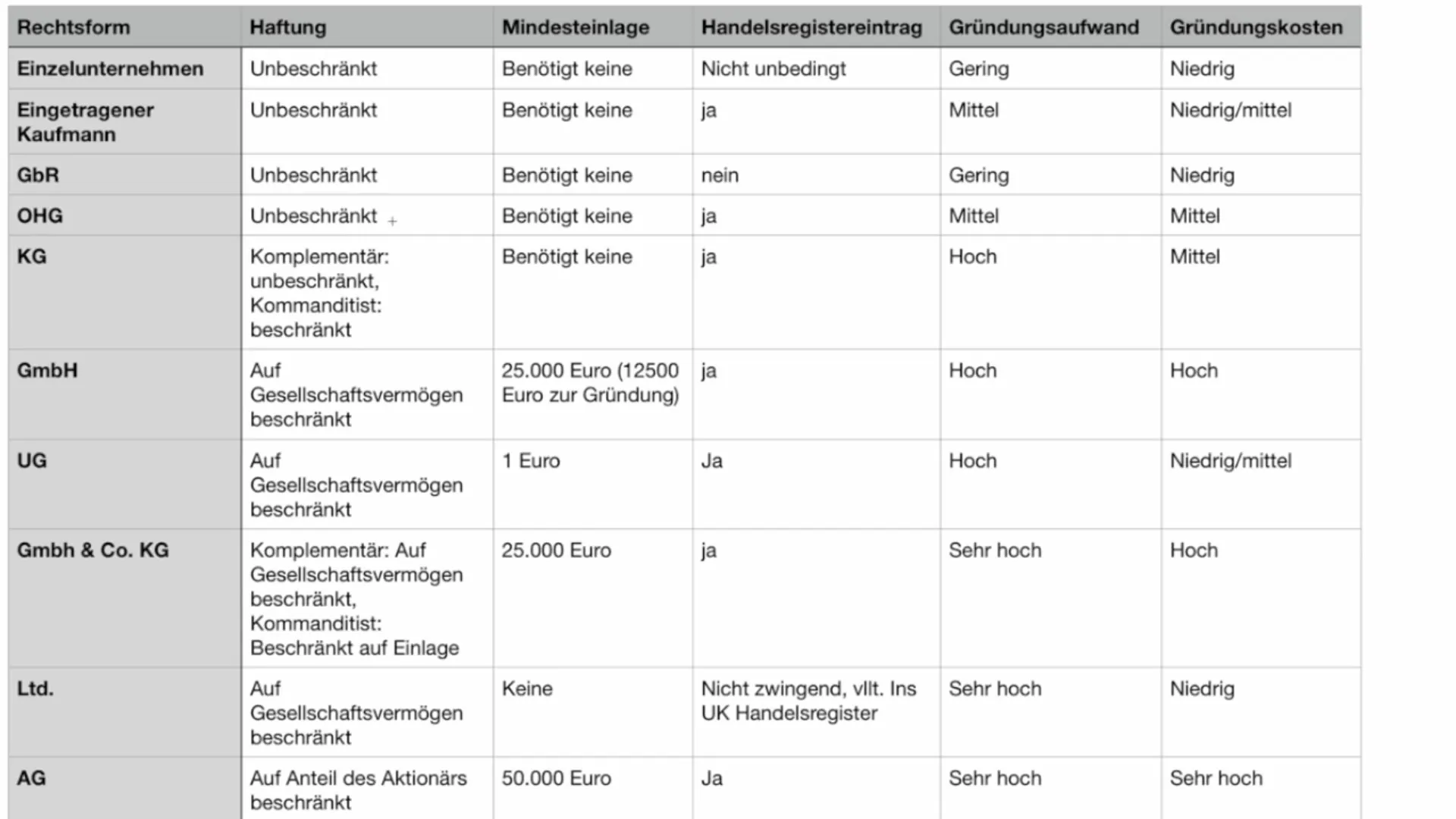

There are various forms of business in Germany, each with its own advantages and disadvantages.

- Sole proprietorship: Simple registration and better suited for beginners.

- GbR: Optimal if you want to found with others, but unlimited liability.

- OHG: Similar to the GbR, but must be registered in the commercial register.

- KG: Offers different roles for partners, allowing liability and responsibility to be regulated.

- GmbH: Most popular form of company, offers limited liability and a minimum capital contribution of €25,000.

- UG: Mini-GmbH, allows formation with just €1 capital.

- AG: Most complex form, ideal for large companies, requires €50,000 as minimum capital contribution.

Step-by-step guide

1. Sole Proprietorship

The sole proprietorship is the simplest form of business. However, you must consider that as a sole proprietor, you are liable with your entire personal assets. The formation is straightforward: a registration at the trade office is sufficient.

The advantages are mainly the simple handling and lower costs. You can quickly respond to market developments by deregistering your business if necessary. This form is particularly well suited for newcomers.

2. Registered Merchant

The registered merchant (e.K.) is an extension of the sole proprietorship. You must register in the commercial register, which involves a certain formality and additional costs.

The liability remains unlimited, which means you are also liable with your personal assets. This is particularly important for craft businesses.

3. Civil Law Partnership (GbR)

If you want to found with friends or business partners, the GbR is a good option. You do not need minimum capital here, and the formation costs are low.

However, all partners are jointly and severally liable. This means that each is liable for the company's liabilities with their own assets.

4. General Partnership (OHG)

The OHG is similar to the GbR but has the advantage that you must register in the commercial register.

This gives the company greater seriousness. Unlimited liability also applies here, which represents a risk for many founders.

5. Limited Partnership (KG)

The KG offers a special structure: You can be both a general partner and a limited partner. While the general partner is liable without limitation, the limited partner is only liable up to their contribution.

This makes it easier for you to define different roles and responsibilities within the company.

6. Limited Liability Company (GmbH)

The GmbH is one of the most popular forms of business in Germany. It protects personal assets and requires a minimum capital contribution of €25,000, of which €12,500 must be paid in immediately.

The formation is more complicated and costly, as you need a notary appointment and a shareholder agreement.

7. Entrepreneurial Company (UG)

The UG is a mini-GmbH that can be formed with just €1. This is ideal for founders who want to invest little capital while still benefiting from the liability limitation of a GmbH.

The UG has similar requirements to the GmbH but requires a higher formation effort for registration in the commercial register.

8. Public Limited Company (AG)

The AG is intended for larger enterprises and requires a minimum capital contribution of €50,000.

The formation costs and effort are very high, making this form often oversized for your online business.

9. Ltd.

The British Limited is another option that has established itself, especially abroad. It has the advantage of limited liability but offers less legal certainty when forming in Germany.

Here you usually do not need minimum capital, which makes it attractive, but one should still be aware of the legal challenges involved.

Summary - Forms of Business in Germany - A comprehensive overview for your online business

This guide has introduced you to the various forms of business in Germany. From the simple registration as a sole proprietor to the complex public limited company, you now have an overview of the advantages and disadvantages of each form. Choose the option that best suits your risk appetite and business endeavor.

FAQ

What is the best option for beginners?The sole proprietorship is the easiest to establish and ideal for newcomers.

How many partners are needed for a GbR?At least two partners are necessary to establish a GbR.

What is the liability in a GmbH?The liability is limited to the company's assets, and your personal assets remain protected.

How much capital do I need for a GmbH?A GmbH requires a minimum capital of €25,000, of which €12,500 must be paid in at the time of establishment.

What are the advantages of a UG?The UG allows formation with just €1 and still offers limited liability.