You are a small business owner and are wondering about your tax obligations, especially when it comes to teaching materials? This guide provides you with a clear overview of the small business regulation in Germany, so you can understand the key aspects surrounding VAT liability. Although I am not a tax advisor, I want to give you the essential information you need to make informed decisions.

Main findings

- Small business owners must pay taxes on their income, regardless of its amount.

- There is a VAT threshold of €22,000 per year that you should be aware of.

- If your revenues exceed this threshold, you are subject to VAT and must comply with the corresponding formalities.

Step-by-step guide

1. Understand the basics of tax liability

Before you delve into the small business regulation, it is important to understand the basics of tax liability in Germany. Regardless of your income level, you must pay taxes on your income in Germany. You should register a business to be on the safe side.

2. Learn about VAT liability

The VAT liability comes into play when your business generates a certain amount of revenue. As of now (July 2024), there is a threshold of €22,000 per year. If your income exceeds this amount, you are liable for VAT. If your revenues are below this, you can benefit from the small business regulation.

3. The small business regulation in detail

As a small business owner, you are exempt from VAT. This means that no VAT will be added to your payments. However, to maintain this status, you must ensure that your annual revenues do not exceed the established threshold.

4. Becoming subject to VAT

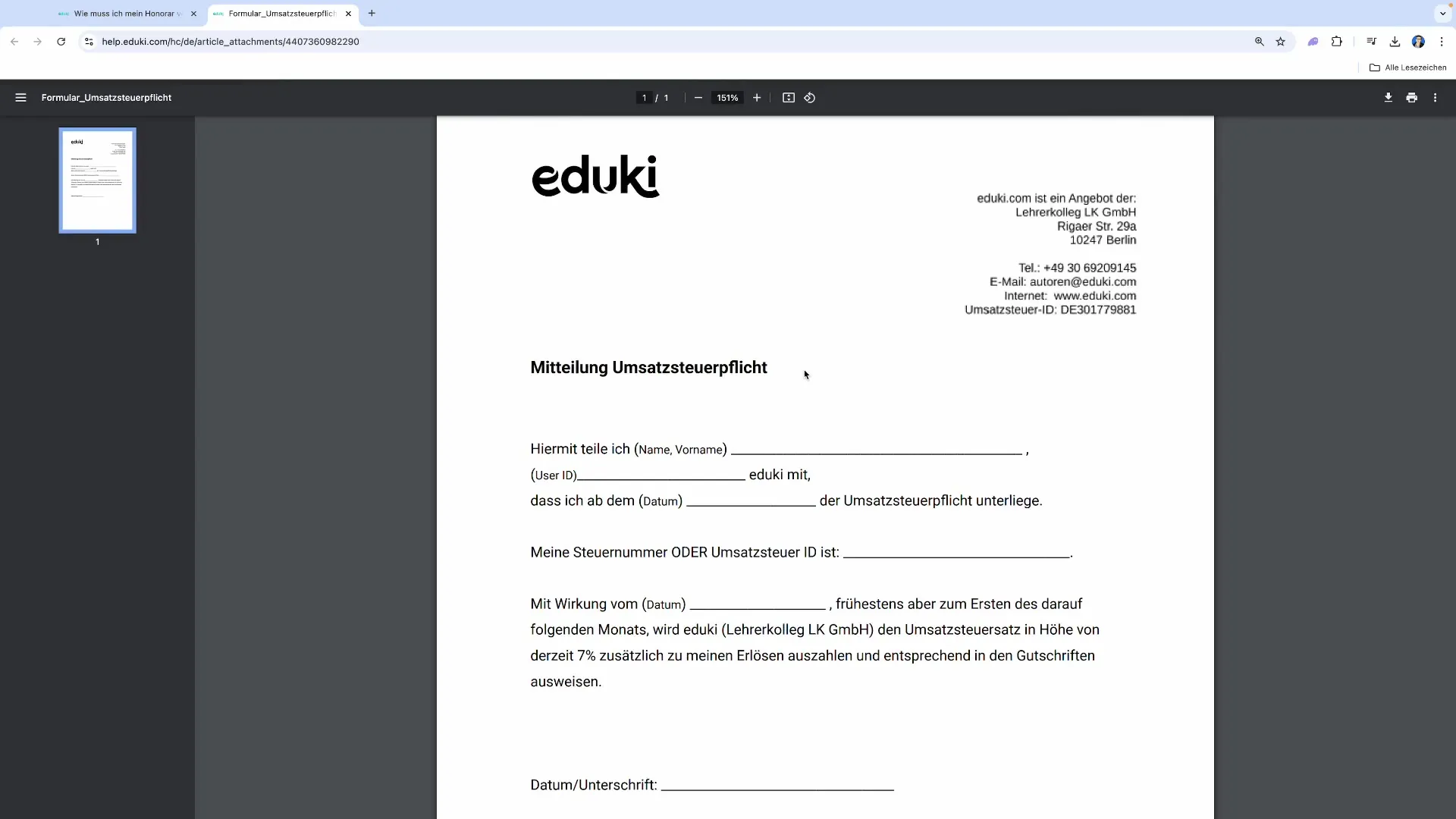

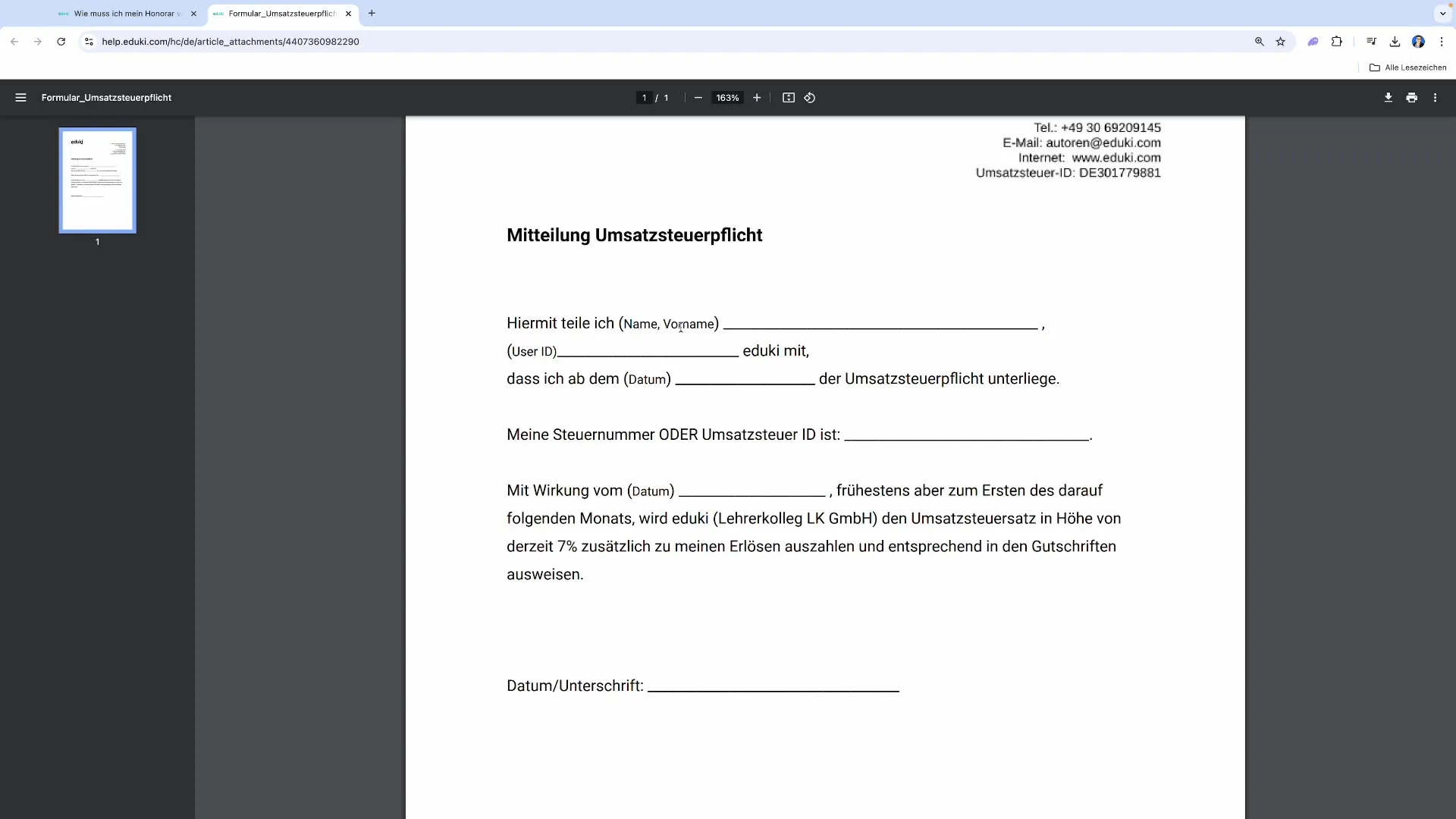

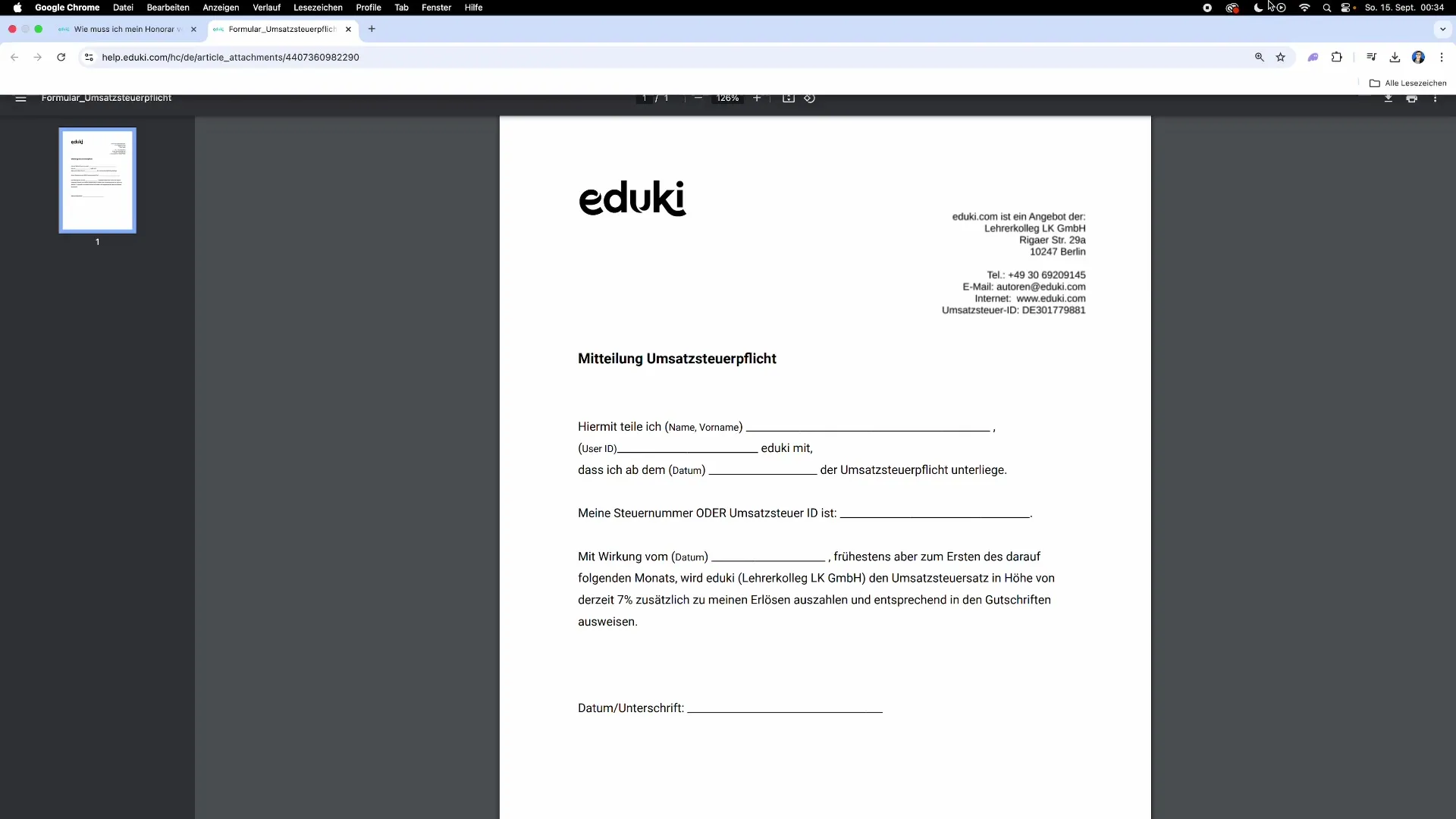

If you find that your revenues exceed the €22,000 threshold, you must report your VAT liability. Visit the relevant website where you can submit the notification. You will find a form in which you need to provide your user ID, your tax number, or VAT ID. This is important to ensure that your payments are recorded correctly.

5. Fill out the VAT liability form

The VAT liability form is relatively straightforward. Fill it out and indicate your active date from when you are liable for VAT. You can usually submit the form digitally to the respective authority.

6. Wait for confirmation

After you have submitted the form, you will receive confirmation of your VAT liability. From the date of your notification, the current VAT rate of 7% will be applied to your payments. You will then also be able to include this amount in your invoices.

7. Keep your documents ready

For future audits or tax declarations, you should keep all relevant documents and confirmations. Whether it is the completed form or the confirmation of your VAT liability. Good documentation is crucial to avoid any legal issues.

Summary - Small business regulation for teaching materials

For you as a small business owner, it is essential to understand the basics of tax liability. You must pay taxes on your income, while the status of being a small business owner spares you from VAT liability, as long as you stay under the revenue threshold. Should you exceed this, it is important to comply with the necessary formalities to report your VAT liability in a timely manner.

FAQ

What is the revenue threshold for small businesses?The revenue threshold is €22,000 per year, as of July 2024.

What happens if I exceed the revenue threshold?If your income exceeds the threshold, you are liable for VAT and must report it.

How do I report my VAT liability?Go to the website of the relevant authority and fill out the VAT liability form.

What kind of fees are we talking about here?It concerns fees that you receive for your services as a small business owner.

Do I always have to consider my taxes as a small business owner?Yes, even as a small business owner, you must pay taxes on your income, regardless of the amount.