The choice of corporate form is one of the fundamental questions when starting a business. For freelancers, the question often arises as to whether a GmbH (limited liability company) is worthwhile. This structured guide takes you on a journey to founding a GmbH and shows you how to take advantage of tax benefits to get the most out of your business.

Key insights

Founding a GmbH can be worthwhile from a stable income of at least 40,000 euros, as it allows for tax optimizations and simpler bookkeeping. Provisions are easier to manage, and the GmbH offers a certain limitation of liability.

Step-by-step guide

1. Assessment of your income situation

To determine if a GmbH is worthwhile for you, it's important to first check your income situation. If your annual revenue is above 40,000 euros and stable, this is an initial indicator that a GmbH could be advantageous.

2. Tax planning

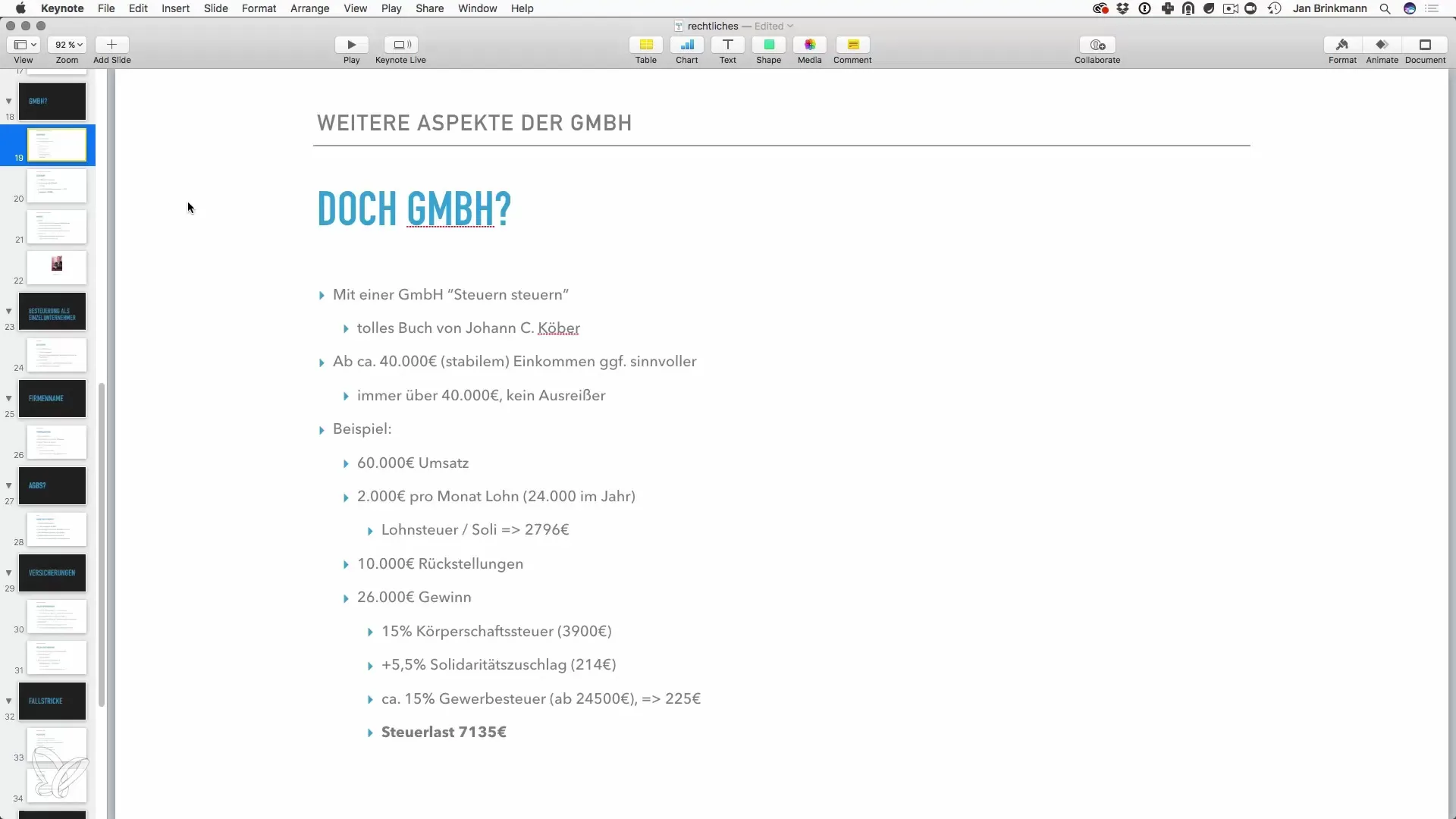

The next step is tax planning. Here, you should engage in a rough calculation. Let's assume you generate 60,000 euros in revenue. From this, you should consider how much you want to pay yourself as salary. At 2,000 euros per month, that would be 24,000 euros a year.

3. Calculation of tax burden

Next, create an overview of your tax burden with the assumed salary. You must also include income tax and the solidarity surcharge. When you calculate the taxes, you'll quickly see how advantageous it can be to book provisions for the GmbH.

4. Effectively using provisions

A central advantage of the GmbH is the ability to create provisions. These provisions can reduce your taxable income. With a profit of 26,000 euros after provisions, the corporate tax is only 15%, whereas as a sole proprietor, you would be at a higher income tax rate.

5. Calculating tax advantages

The corporate tax, the solidarity surcharge, and the trade tax that may also apply need to be calculated. These vary depending on your place of residence, but generally have a tax exemption up to a certain amount. Use this information for your planning.

6. Decision for the GmbH

Now that you have thoroughly considered the tax advantages and provisions, you can decide whether the GmbH is indeed the right choice for your business. The decision should also be made with regard to the limitation of liability and the better management of profits.

7. Discussing challenges and risks

There are also challenges with the GmbH that you should consider. For example, the salary you want to pay yourself from the GmbH is subject to strict rules. This can be problematic during phases with irregular income. Solid financial management is absolutely essential.

8. Reviewing alternatives

Finally, you should also consider the option of working as a sole proprietor. This can be sensible for you if your income is not yet stable enough to effectively use the GmbH's provisions.

Summary – Starting a business as a freelancer: Founding a GmbH and optimizing taxes

Founding a GmbH can be the better choice for freelancers, especially if a certain income is earned consistently. The possibility of provisions and more reliable tax optimization can save a lot of money.

Frequently asked questions

What are the advantages of a GmbH?A GmbH offers liability limitation and tax advantages through provisions.

When is a GmbH worthwhile?A GmbH can be worthwhile from a stable income of 40,000 euros.

What should be considered regarding the payout rules of a GmbH?The salary cannot be arbitrarily increased or reduced; it must be sufficient for personal expenses.

How do provisions work in a GmbH?Provisions can help reduce taxable income and create financial liquidity.

Is founding as a sole proprietor advantageous?Voluntarily creating provisions as a sole proprietor is difficult and often not profitable.