You have decided to launch as a freelancer? That is an exciting decision that offers many opportunities. However, you should not lose sight of the legal aspects, as they form the foundation of your future self-employment. In this guide, you will receive a comprehensive overview of the most important legal questions and aspects you should consider as a freelancer.

Key insights A business plan is essential for establishing your company. The choice of the appropriate legal form has far-reaching consequences, both fiscally and financially. Additionally, various insurances and understanding General Terms and Conditions (AGB) are crucial for legal protection.

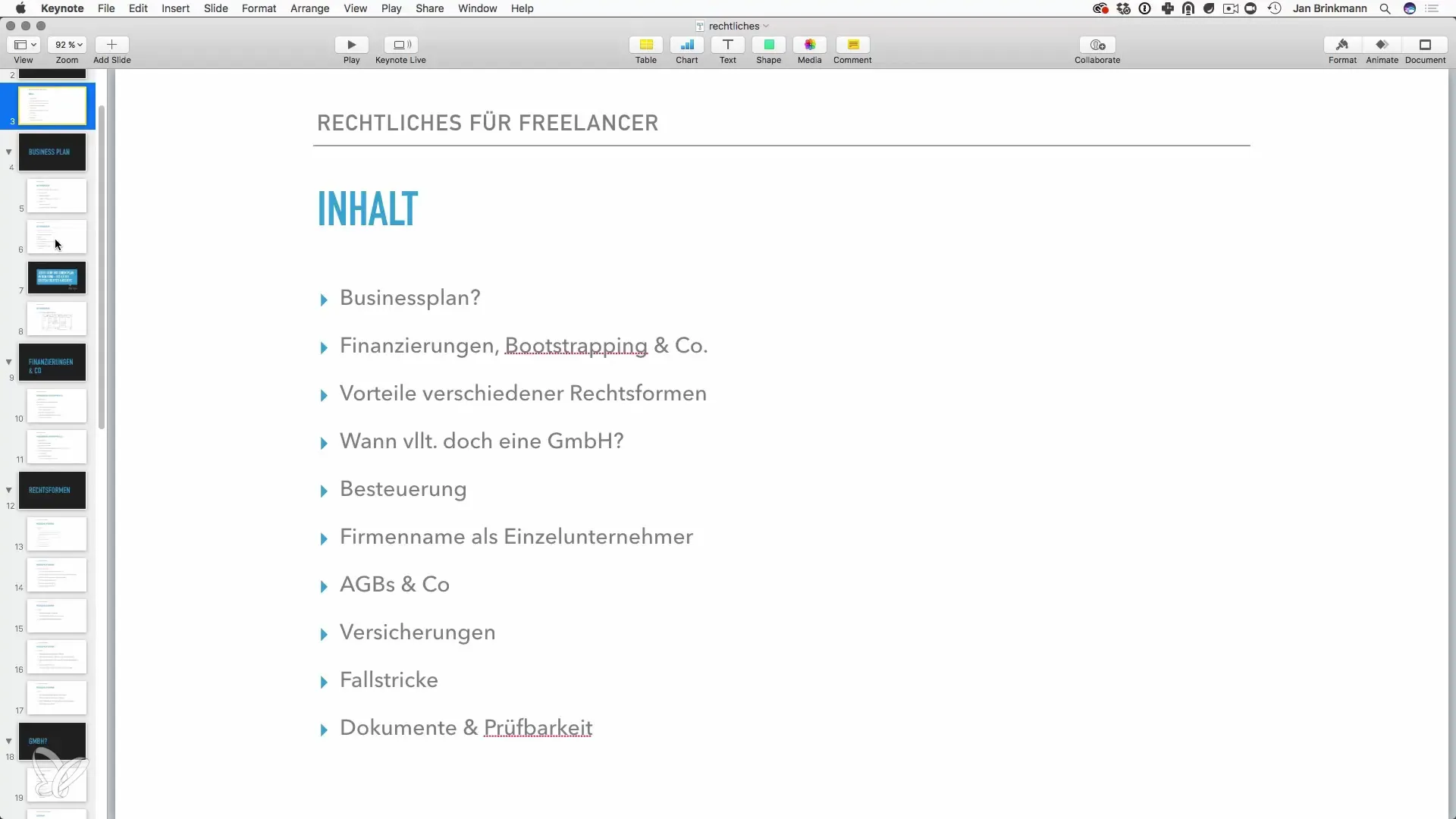

Step-by-Step Guide

1. Create a business plan

A structured plan is the be-all and end-all for your success as a freelancer. The business plan helps you clearly formulate your business idea and plan the next steps. You should include aspects such as target audience, market analysis, and the financing of your business.

2. Consider financing options

Financing is a central point that you must deal with. Options such as loans or government grants should be examined to secure the necessary leeway for starting your self-employment. A solid financing strategy gives you more security and planning flexibility.

3. Choose the right legal form

The choice of legal form affects not only taxation but also your personal liability and administrative complexity. Whether sole proprietorship, GbR, or GmbH – each form has advantages and disadvantages. Consider which structure is best suited to your individual needs.

4. Clarify tax aspects

Depending on the legal form, different taxes apply. As a freelancer, you must deal with income tax, sales tax, and possibly trade tax. Inform yourself thoroughly about this to avoid unpleasant surprises.

5. Company name and branding

The company name is not only a legal decision but also an important part of your branding. Make sure that the name is legally protected and helps you address your target audience. Memorable and legally secured names are advantageous.

6. General Terms and Conditions and legal framework

General Terms and Conditions (AGB) are an important legal foundation for many freelancers. They regulate the relationships with your customers and protect you from legal claims. It is worthwhile to seek legal advice here and create individual AGB.

7. Find the right insurance coverage

A secure existence also requires a well-thought-out insurance strategy. Depending on your field of activity, professional liability insurances, legal protection insurances, or other policies may be necessary. Analyze your risks and take an active role in your protection.

8. Know and consider pitfalls

There are many legal pitfalls you can easily fall into. These include, for example, the correct handling of invoices, data protection regulations, or compliance with consumer protection rights. It is advisable to inform yourself thoroughly and seek support if necessary.

9. Organize document retention

Proper storage of your documents is crucial for traceability in your business. Make sure to collect and organize all important documents well so that you can quickly provide the necessary information in case of audits.

Summary – Legal Foundations for Freelancers: A Guide

Understanding and considering the legal foundations is crucial for your success as a freelancer. A well-thought-out business plan, the selection of the right legal form, tax and insurance aspects, as well as adaptable AGB, help you stay on the safe side.

Frequently Asked Questions

What is a business plan?A business plan is a document that clearly describes your business idea, target audience, and financing strategies.

Which legal form is best for freelancers?It depends on your individual needs. Sole proprietorships are easy to establish, while GmbHs offer more liability protection.

How relevant are AGBs?AGBs are important for clarifying legal requirements and securing your business dealings.

Do I need insurance as a freelancer?Yes, insurance protects you from financial risks that can arise from your activities.

Where can I find support for legal questions?It is advisable to consult a lawyer or tax advisor who specializes in corporate law.