Starting your own existence as a freelancer is an exciting challenge that many begin with a big dream, but often fail at pricing. A central aspect that many newcomers underestimate is their own hourly rate. In this guide, I will show you how to calculate your hourly rate effectively while considering all important factors.

Key Insights

- Calculate your hourly rate considering your costs and requirements.

- Plan enough time for administrative tasks, marketing, and personal breaks.

- Utilize online tools available for assistance with pricing.

- Keep an eye on your competitors to develop realistic pricing.

Step-by-Step Guide to Calculating Your Hourly Rate

1. Determine Your Monthly Costs

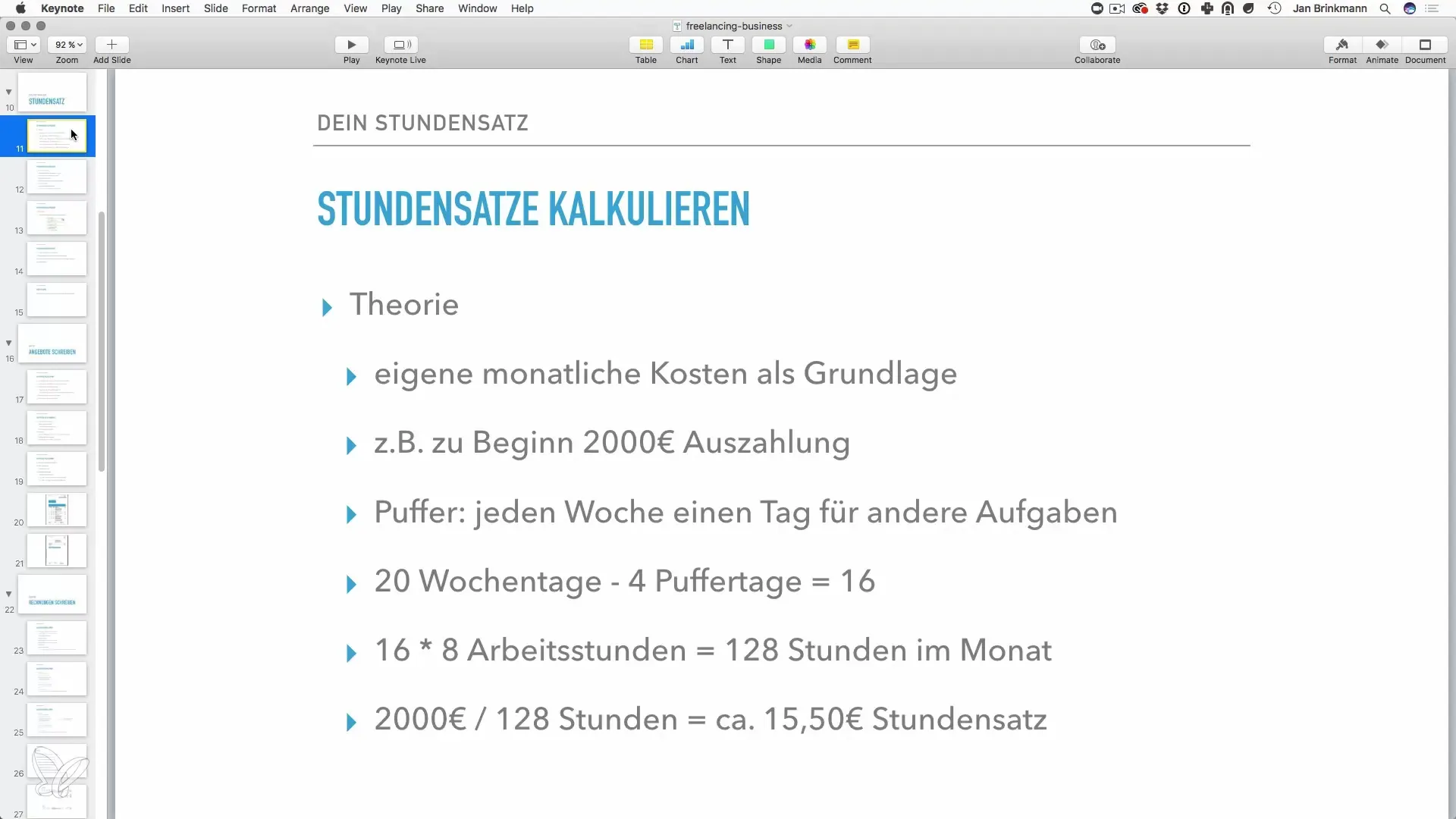

As a freelancer, do not be tempted to cover only the minimum requirements. Start by determining your monthly costs. This is quick and easy: Suppose you want to pay yourself €2,000 monthly. This serves as the basis for your calculation.

2. Plan Free Time and Buffer Days

You should not assume that you can or should work every day of the week. Plan for 5 working days per week and consider at least one buffer day per week for administrative tasks and unexpected activities. For instance, you would have 16 working days per month if you plan for 4 buffer days.

3. Calculate Effective Working Hours

Starting from the 16 working days, consider how many hours you actually want to work. If you work 8 hours each of the 16 days, you will have a total of 128 hours per month to determine your hourly rate.

4. Calculate the Basic Hourly Rate

Now that you have your target value of €2,000 and your effective working hours (128 hours), you can calculate your base hourly rate. Divide your monthly earnings by the number of working hours per month. For €2,000 and 128 hours, you would have an hourly rate of €15.50.

5. Consider Operating Costs

The hourly rate calculated now covers only your expenses for your own salary. However, there are additional operating costs that should also be factored in. These include:

- Income tax: This can vary based on your income and applicable tax rates.

- Trade tax: You may also have to calculate this depending on your location.

- Chamber of Commerce membership fees: This mandatory fee also costs money and should be reflected in your hourly rate.

6. Additional Costs and Insurance

Remember that you not only want to cover your expenses. You also need to be able to invest in insurance and retirement savings. Make sure to include costs like liability insurance and other professional insurances in your calculation.

7. Use Online Tools for Calculation

Use online calculators to calculate your hourly rate, such as the fee calculator from guru-20.info. These resources can help you find a more comprehensive basis for your pricing, including potential profit margins and variable costs.

8. Compare with Competitors

Comparing yourself with other freelancers in your industry is a crucial step in setting your hourly rate. Pay attention to how much similar services cost in your field. Use these prices to ensure competitiveness without underpricing yourself.

9. Analyze and Adjust Results

Once you have set your hourly rate, remember that this is a dynamic process. Monitor how your business develops. If you consistently receive orders, it may be worthwhile to gradually adjust your hourly rate to reflect your value in the industry.

10. Regularly Review Your Hourly Rate

It is important to regularly review and adjust your hourly rate if necessary. Your costs, the market environment, and your experience increase over time, and your prices should reflect these factors.

Summary – How to Properly Set Your Hourly Rate as a Freelancer

Calculating your hourly rate is an essential skill that helps you establish your career as a freelancer on a solid foundation. Be sure to include all your costs and any reserves to ensure that you not only get by but also succeed in the long term.

Frequently Asked Questions

How much should my hourly rate be?Specify how much you want to earn monthly and consider your working hours as well as all operating costs.

How do I account for time for marketing?Plan for at least one buffer day per week for marketing, bookkeeping, and other administrative tasks.

Can I adjust my hourly rate at any time?Yes, it is advisable to regularly review and adjust your hourly rate based on market changes and personal growth.

How can I be sure that I am not setting it too low?Compare your hourly rate with the market and refer to online calculators to check the appropriateness of your pricing model.

What should I do if I am not getting orders?Start with a slightly lower hourly rate to attract initial clients and then build references and experience.