If you start your own business as a freelancer, the topic of taxation is often one of the biggest hurdles. Knowing about your tax obligations is crucial for your long-term success. This guide provides you with a clear overview of the most important tax aspects that you, as a sole proprietor, will encounter and shows you how to effectively master them.

Key Insights

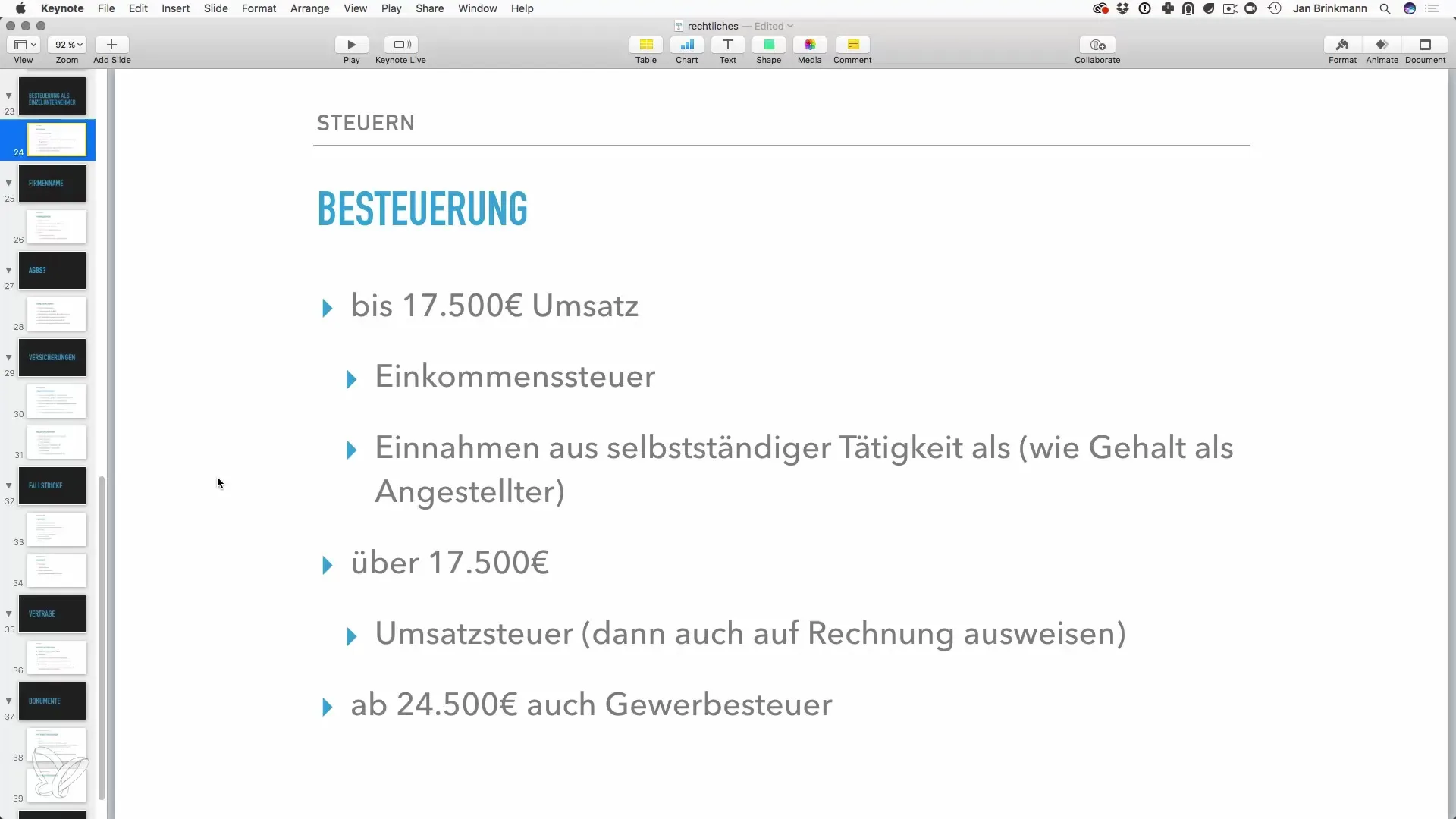

- Up to a revenue of €17,500, your tax situation is relatively uncomplicated.

- The income tax is managed like for employees and is expected to be paid in the following year.

- Above a revenue of €17,500, you are required to collect and report VAT.

Step-by-Step Guide to Taxation as a Sole Proprietor

The tax requirements for you as a sole proprietor may initially seem overwhelming. Therefore, it is important to go through everything step by step.

1. Registering Your Business

Before you deal with taxes, you need to register your business. This is the first step in your self-employment journey. Once your business is registered, you are ready for the tax aspects of your activity.

2. Keep an Eye on the Sales Limit

A central aspect is your sales limit of €17,500. As long as you stay below this amount, taxation is relatively simple. You do not have to collect VAT. It is sufficient to declare your income in your tax return.

3. Tax Return and Income Tax

Once you have registered the business, you also need to pay income tax. This is treated similarly to how it's handled for employees. You declare the income from your self-employment in your tax return.

4. Plan Advance Payments

After your first tax return, you are expected to pay taxes for the previous business year. It is advisable to set up advance payments to avoid financial surprises. The tax office can also set advance payments for the coming years.

5. Collect VAT

If you exceed the revenue of €17,500, you are required to collect VAT. You must show this on your invoices and also submit it in the corresponding advance declaration. This requires additional administrative steps that you should not underestimate. Consulting a tax expert can be of great benefit here.

6. Trade Tax and Accounting

If your revenue exceeds €245,000, you must also pay trade tax. If your profit exceeds €50,000, it becomes necessary to keep double-entry bookkeeping, which entails additional effort. Here as well, it is wise to inform yourself in advance or seek support in a timely manner.

7. The Path to Tax Optimization

With knowledge of your basic tax obligations, you are already in a good position. Make sure to keep track of all relevant deadlines and continuously inform yourself about possible tax regulations and optimization opportunities. Good preparation and planning ensure that you remain on safe ground in the next business year.

Summary – Taxation as a Sole Proprietor: How to Become a Tax Professional

Being self-employed as a sole proprietor can be exciting and challenging. With a solid understanding of your tax obligations and careful planning of advance payments, you are well-equipped to focus on the core of your business. The aim is to fulfill your tax obligations while also ensuring that the costs of taxation do not become a financial burden.

Frequently Asked Questions

What do I need to do to register a business as a sole proprietor?You need to register your business with the appropriate trade office and submit the necessary documents.

What happens if I make more than €17,500 in revenue as a sole proprietor?Above this revenue, you must collect VAT and conduct an appropriate advance declaration.

How do I manage my income tax as a self-employed person?The income tax is recorded in your tax return like it is for employees.

When do I have to make advance payments to the tax office?Typically, after your first tax return, advance payments must be made for the following year.

What happens if I increase my profit above €50,000?Then you must keep double-entry bookkeeping and may have to pay additional trade tax.