The path to self-employment as a freelancer brings many challenges. One area that is often neglected is finance. A structured financial management is the key to the long-term success of your business. Here you will learn how to effectively organize your business income and expenses to not only meet your tax obligations but also create a financial cushion for unforeseen events.

Main insights

- Use the small business regulation to secure tax advantages.

- Keep track of your income and expenses using the income surplus calculation.

- Establish a system of multiple accounts to structure your finances and build reserves.

Step-by-step guide

1. Choose the right business form

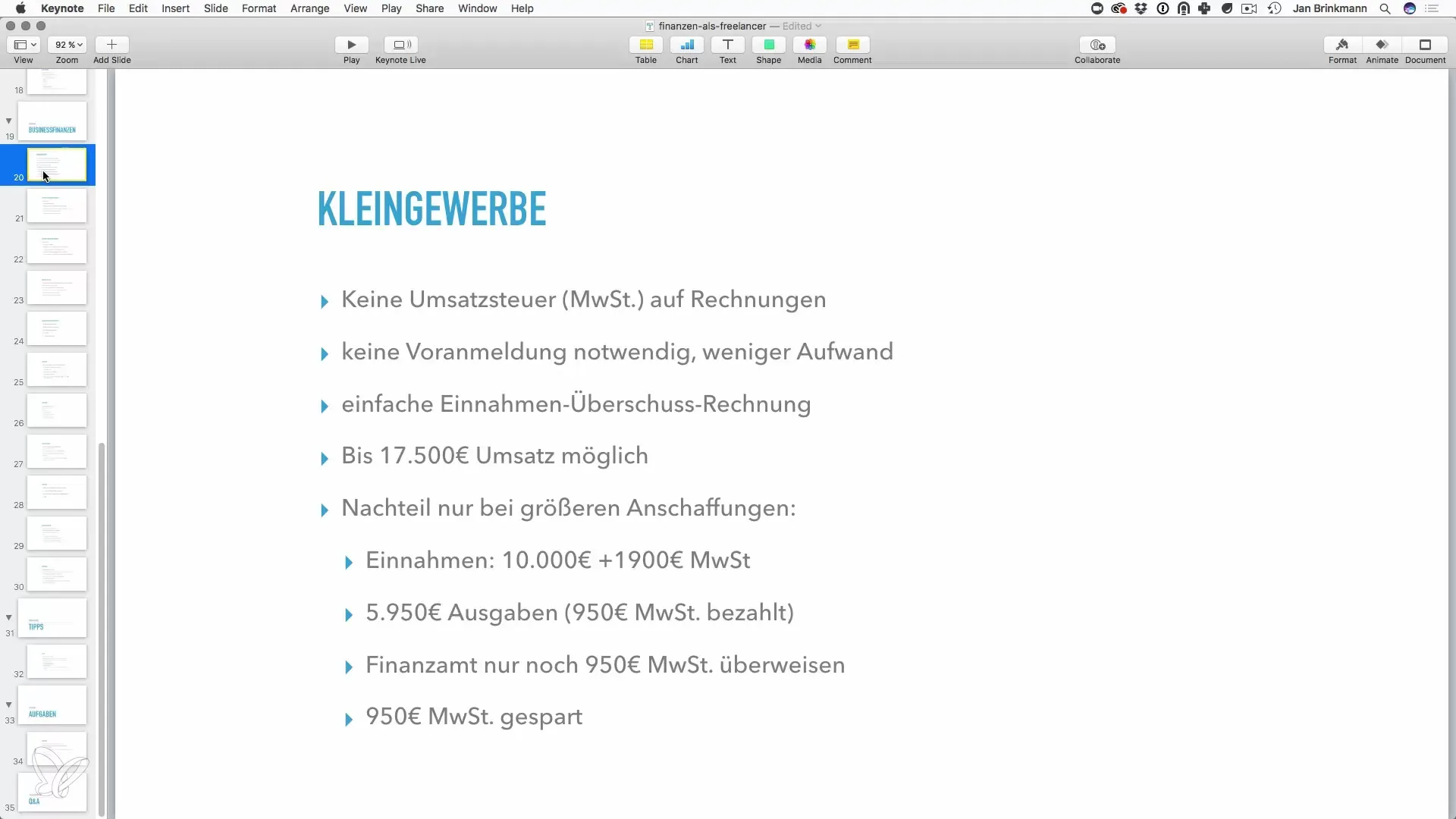

One of the first decisions you need to make as a freelancer is choosing the business form. If you are just starting out, it may be beneficial for you to establish a small business. This allows you to benefit from simplified tax regulations. You do not have to show VAT on your invoices and save yourself the complicated VAT advance notifications. This leaves you more time for your actual business.

2. Maintain an income surplus calculation

With a small business, the income surplus calculation (EÜR) is the best way for you to manage your financial data. You can easily keep this in an Excel spreadsheet. Record all your income in one column and all your expenses in another. Once you have this overview, you can clearly see what profit you have generated.

3. Consider tax obligations

If your income exceeds 17,500 euros, you must keep an eye on VAT and income tax. Let's say you have an income of 10,000 euros, of which 1,900 euros are VAT. If you have expenses of 5,000 euros, you can deduct 950 euros of the VAT paid from your taxes. It is important to properly account for these items to have a realistic overview of your liquidity.

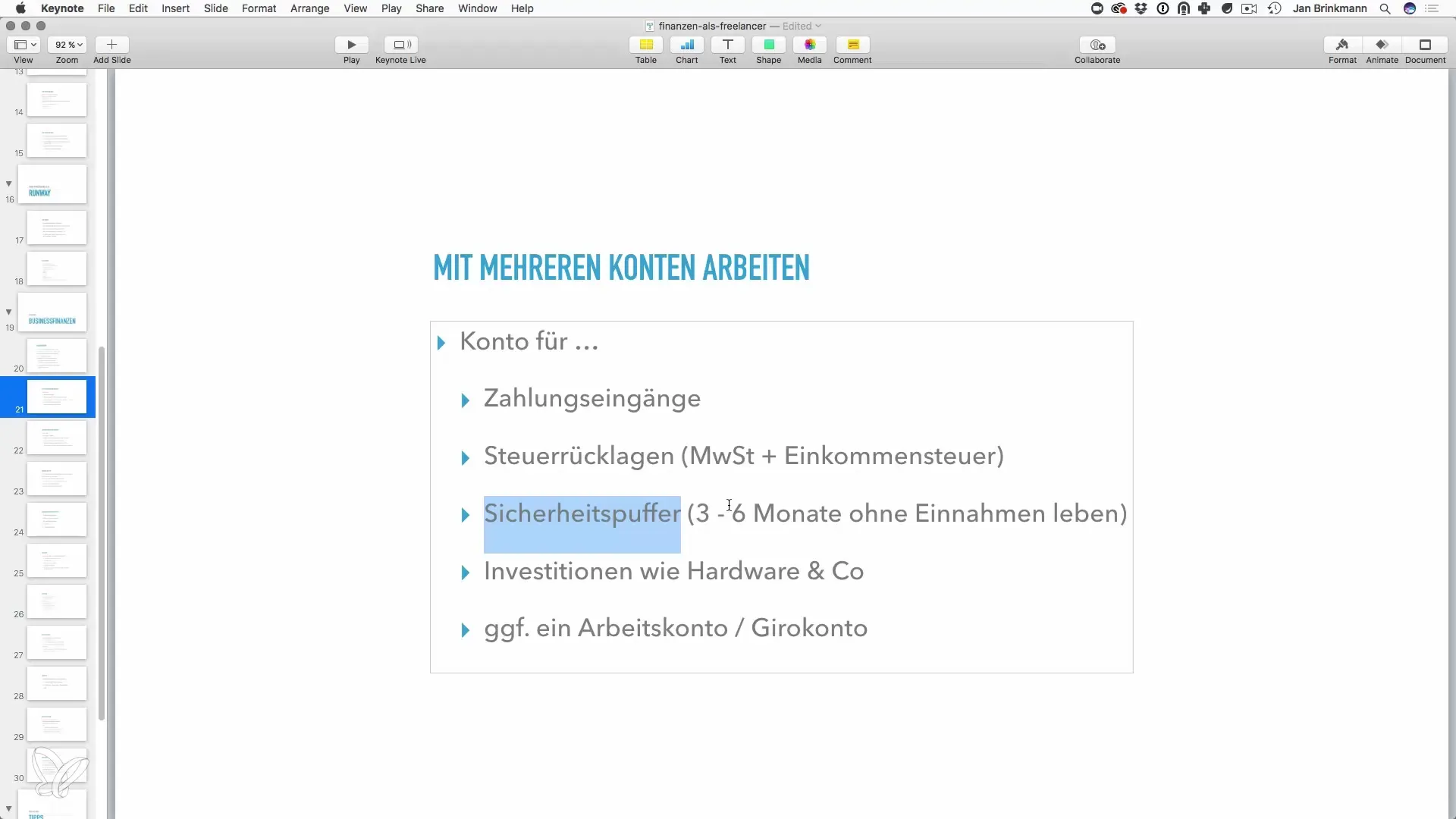

4. Build reserves for taxes and expenses

Effective financial management requires you to build reserves for taxes and other charges. I recommend keeping a separate account for these reserves. Set aside 40% of your income into this account so that you are prepared for all financial obligations. It gives you security and enables you to safeguard your business expenses over a longer period.

5. Create a security buffer

A financial security buffer is essential to be well-prepared during crises. Calculate your fixed monthly expenses and multiply them by the number of months you want to secure. For example, if your business expenses are 200 euros per month, you should accumulate at least 1,200 euros for 6 months.

6. Plan investments proactively

It is advisable to include important investments such as hardware or software in your financial plan. If, for example, you need a new laptop every three years, plan an annual reserve of 1,000 euros. This way, you will be prepared when the time comes and can make larger purchases without financial pressure.

7. Set up a working account

A separate working account is an excellent way to keep finances organized. All business income and expenses are handled through this account. This can save you time and effort on accounting, as all relevant financial data is managed centrally.

8. Analyze regular inflows and outflows

To optimize your financial overview, create a possible calculation for your income. Let's assume you receive 1,000 euros – divide this amount into different categories such as tax reserves, savings, and investments. This helps you manage your financial resources better and avoid unexpected shortages.

9. Create financial resilience

By following the steps above, you not only build a solid financial foundation for your business but also secure the freedom to make decisions without the pressure of financial uncertainties. When you are prepared for unforeseen events, you can maintain calmness and offer your services at a high level.

Summary – how to manage your business finances as a freelancer in a structured way

Effectively managing your business finances is the key to long-term success as a freelancer. Start by choosing the right business form, utilize the income surplus calculation, build reserves, and carefully plan your investments. Through this structured approach, you create the conditions for successful work in self-employment.

Frequently asked questions

How can I minimize my tax burden?By properly accounting for all relevant expenses and deducting them from your income.

When is a small business beneficial for me?A small business is ideal for you if you stay below 22,000 euros in revenue per year.

How do I maintain an income surplus calculation?Keep track of all your income and expenses in an Excel spreadsheet.